Is it tax abuse to share income with your spouse?

The tax general anti-abuse rule (GAAR) is now law, and there have been rumblings that HMRC will use this to attack income shifting between

The tax general anti-abuse rule (GAAR) is now law, and there have been rumblings that HMRC will use this to attack income shifting between

According to The Sunday Times there are a number of individuals who may become a casualty of the new pension revolution announced by George Osborne

According to the BBC, the government have announced that the national minimum wage will increase at the beginning of October 2014 by 19p an hour and is

HMRC will introduce in-year penalties for failing to file PAYE submissions on time from 6 October 2014. Therefore, all submissions for your PAYE scheme should

It’s clear that the government are taking notice of the huge impact that small businesses have on the UK economy as a whole and if there is

You might have heard in the news recently that the Government has announced changes to the way student loans are repaid. Firstly, it’s best to

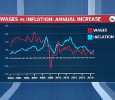

Calculations show that ‘real’ pay packets shrank by more between 2009 and 2013 than at any period since the Victorian age. Britain is much poorer

HMRC are seeking additional powers to take money directly from individuals’ bank accounts. If approved by parliament, which is by no means certain, it will

The FTT has allowed an appeal against a late payment penalty finding in Brown v Revenue & Customs [2014] UKFTT 208 (TC). The appellant, Mr

Guardian Money has scored a victory in its campaign against websites that charge rip-off prices for services such as passport renewal Filling in a self-assessment

Her Majesty’s Revenue & Customs has had its wrists slapped by the House of Lords for failing to justify its crackdown on freelancers and contractors

The Marlborough School Apprenticeship event we attended gave students at Marlborough and across Oxfordshire the opportunity to find out more about apprenticeships. They heard first-hand from businesses who have employed