A new annual flat rate expense allowance for laundering uniforms has been agreed between HM Revenue & Customs and the Ministry of Defence.

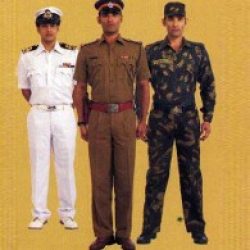

The following annual Flat Rate Expense Allowance (FREA) will be put in place for laundering your uniform:

• Royal Navy £80

• Army £100

• Royal Marines £100

• Royal Air Force £100

If you claim the FREA

The FREA will be backdated from 6 April 2008. You will get the full expense allowance due for each year of service. It will not be reduced if your service started or ended part-way through a year.

The FREA will be given by amending your tax code for the 2013 to 2014 tax year. In most cases the revised tax code will be used against March 2014 pay. This will usually mean you will pay less tax in the month the revised tax code is used. If you are not currently in employment but you complete a Self Assessment tax return the allowance will be added to your Self Assessment statement of account.

HM Revenue & Customs (HMRC) pay compensation where there is a delay in making a repayment. This is called a repayment supplement (RPS). This will also be included in the backdated tax code adjustment.

The average annual interest rate over the period is 0.5%.

If you want to claim an allowance for the actual expenses you have paid, you will need to contact HMRC.